bexar county tax office property search

PROPERTY SEARCH Search property by name address or property ID MAP SEARCH. Use this field to search for the name of a GrantorGrantee or by subdivision document type or document number.

Funding Shortfalls Hamper Bexar County Courts Tpr

Search Bexar County TX property records by Owner Name Account Number or Street Address.

. Enter an account number owners name last name first address CAD reference number then select a Search By option. Final processing may take several days. Pro members in Bexar County TX can access Advanced Search criteria and the Interactive GIS Map.

Provides services for property tax collections motor vehicle registration and titling functions. Online portals to make certain types of payments. Southside - 3505 Pleasanton Rd.

Get Property Records from 2 Treasurer Tax Collector Offices in Bexar County TX Bexar County Tax Collector 233 N Pecos La Trinidad San Antonio TX 78283 210-335-2251 Directions Bexar County Tax Collector 640 Southwest Military Drive San Antonio. Electronic payments will be pending until it clears from your bank account. The County Clerk is proud to announce the Vanguard Property Alert a free property alert system for Bexar County property owners.

Owner Name Last name first Property Address Account Number CAD Reference Number. Free Bexar County Property Tax Records Search Find Bexar County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Be Your Own Property Detective.

Gutierrez pcc director property tax department richard salas esq. Pecos La Trinidad. Resources and searches to help you find the information you need.

We want to provide our local community with resource options to stay informed or dispute your property taxes if you are concerned it may be overvalued. Bexar County Clerks Office 100 Dolorosa suite 104 San Antonio Texas 78205 Phone. Sign up for free tax assessment.

Delinquent Tax Data is. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. Bexar County TX Property Tax information.

Downtown - 233 N. Subscribers will receive an email when a document is recorded in the countys Public Records using their name or identifier. Please follow the instructions below.

Reports Record Searches. You can search for any account whose property taxes are collected by the Bexar County Tax Office. Bexar County Payment Locations.

In-depth Property Tax Information. See what the tax bill is for any Bexar County TX property by simply typing its address into a search bar. Property Tax Pay Taxes OnlineBy Phone Pay Taxes Online For your convenience the Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check eCheck.

All members can search Bexar County TX appraisal data and print property reports that may include gis maps land sketches and improvement sketches. Search Any Address 2. The county of Bexar.

BEXAR COUNTY TAX ASSESSOR-COLLECTOR. Property Tax Payment Options. P O BOX 839950.

All amounts due include penalty interest and attorney fees when applicable. Resources and request portals for Bexar County Information. SAN ANTONIO TX 78283-3950.

Begin a New Search Search for. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state.

Northeast - 3370 Nacogdoches Rd. Search for records and reports of various types. 210-335-2581 Electronic Filing of Real Property Documents For your convenience the Bexar County Clerks Office is pleased to announce its implementation of electronic recording.

Unless otherwise noted all data refers to tax information for 2021. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to roll back or limit tax. Northwest - 8407 Bandera Rd.

Search Index Full Text OCR. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices. See Property Records Tax Titles Owner Info More.

More about the alert and subscribing. See Bexar County TX tax rates tax exemptions for any property the tax assessment history for the past years and more. Bexar County TX Property Tax Search by Address.

For website information contact 210 242-2500. Bexar county tax assessor collector. For property information contact 210 242-2432 or 210 224-8511 or email.

3 rows Tax Assessor-Collector. Find Your Property Tax Account. 2428 likes 81 talking about this.

Our office is committed to providing the best customer service possible for all our citizens. Search For Title Tax Pre-Foreclosure Info Today.

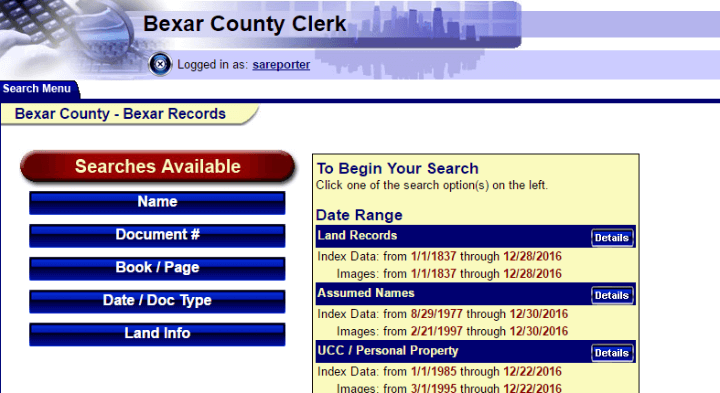

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Property Tax Information Bexar County Tx Official Website

Bexar County Tax Assessor Collector Albert Uresti Bexar County Tx Official Website

Everything You Need To Know About Bexar County Property Tax

Information Lookup Bexar County Tx Official Website

Real Property Land Records Bexar County Tx Official Website

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You